Hot take: use traditional marketing to build broad reach and brand memory; or if you want to capture and harvest demand, use digital marketing; but we’ve seen most of the brands these days are working a hybrid strategy. It’s actually smart to start with a brand/activation split (the 60/40 rule), then let real experiments (re)decide budget. This post includes a matrix, a budget calculator, and a 30-day plan… minus the oversight.

TL;DR / What you can use today

- A jobs-to-be-done matrix that shows when traditional wins, when digital wins, and when hybrid is non-negotiable.

- Three starter budget splits (Local Lead Gen, D2C, B2B).

- A cookie-agnostic measurement plan that actually works in 2025.

- A ready spreadsheet to model spend and impressions across channels. → Download the Budget & Impressions Calculator

Digital Marketing vs Traditional Marketing

Traditional marketing = offline channels (TV/CTV, radio, print advertising in newspapers/magazines, OOH/billboards, direct mail, events). They excel at broad reach and mental availability, the foundation for growth.

Digital marketing = online channels (search engine optimization (SEO) and paid search, social media marketing and social media ads, online video/CTV, display/programmatic, email marketing, influencer/creator, retail media). They excel at targeting, speed to learn, and conversion.

➡️ If social is a core channel, social media marketing deserves its own plan and measurement cadence.

Reality: digital now captures ~70 %+ of global ad spend. GroupM/Reuters puts it at ~73.2 % for 2025; Dentsu’s global model shows ~68 % with double-digit growth in retail media and social. “Traditional” today usually means CTV/radio/OOH, not just print.

The jobs-to-be-done matrix

| Job | Traditional wins when… | Digital wins when… | Hybrid (most common) |

|---|---|---|---|

| New brand or market entry | You need fast, broad reach (TV/CTV, radio, OOH) to seed awareness. | There’s immediate search/social intent to capture. | Run CTV/OOH for reach, and search/social to harvest demand generated. |

| Seasonal spike / promo | Local mass channels (radio/OOH) move footfall now. | Price-sensitive shoppers respond via search, retail media, social ads. | Burst traditional + precision digital; coordinate offers and measure lift. |

| Low online-intent categories | Discovery is mostly offline; fame drives prominence. | Rich storytelling via YouTube/online video and creators shapes preference. | Use OOH/CTV to seed; video + creators to deepen. |

| Enterprise ABM | Direct mail and events cut through noise for high-value accounts. | LinkedIn/programmatic ABM/search capture and nurture. | DM kits + LinkedIn + targeted CTV; measure pipeline created. |

| Price-led retail push | Radio/OOH + print inserts change store behavior. | Retail media/search convert at shelf and online. | Geo split tests across radio/OOH vs retail media/search. |

Why this frame? It matches how people actually consume media now: streaming time keeps climbing (streaming hit 44.8 % of U.S. TV usage in May 2025, topping broadcast+cable), while 53 % of U.S. adults at least sometimes get news on social media. Your mix must reflect that consumption reality.

Key differences

| Dimension | Traditional | Digital | What to do with this |

|---|---|---|---|

| Primary job | Build reach and brand memory | Target, learn, convert | Don’t starve reach then blame performance plateau. |

| Speed to learn | Slower cycles | Fast iteration (audience, creative, bids) | Use digital to test messages that fuel traditional. |

| Targeting | Broad demos, geo | Fine-grained audiences, in-market signals | Tie broad reach to narrow capture (retail/search). |

| Measurement | Lift tests, MMM, geo holdouts | UTMs, GA4, platform reporting, incrementality | Triangulate micro + meso + macro (see below). |

| Longevity | Fame compounds (brand) | Performance saturates without brand | Balance long-term brand with short-term sales. |

| Cost shape | Often higher CPM; powerful at scale | Variable CPM/CPC; high competition | Use real quotes; run our calculator, not myths. |

| Creative | Fewer, bigger bets (TV commercial, radio) | Many variants, continuous testing | Share learning both ways; creative is your growth lever. |

The numbers

- Spend picture: global ad revenue ~$979B–$1.08T in 2025; digital ≈ 68–75 % share across leading forecasts. Retail media and social are major growth engines.

- Screen reality: streaming eclipsed broadcast+cable in May 2025 (44.8 % of TV usage), shifting video budgets toward CTV/online video.

- News/attention: ~53 % of U.S. adults sometimes get news from social; 86 % sometimes get news on a phone/computer/tablet. Creator ecosystems keep outpacing legacy media in ad growth.

👉 Takeaway: the center of gravity is digital, but reach at scale (CTV/radio/OOH) still drives the mental availability that performance needs.

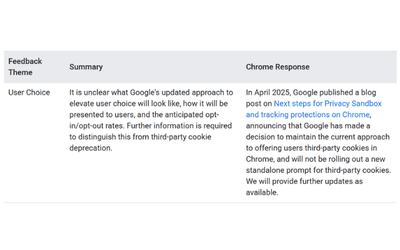

Measurement without magical cookies

Chrome did not remove third-party cookies. In April 2025, Google said it would maintain third-party cookies and dropped plans for a new “user choice” prompt. Regulators (CMA) continue to monitor Privacy Sandbox and related changes. Don’t plan around moving goalposts; build a cookie-agnostic stack now.

Practical stack:

- Micro (week-to-week): GA4, clean UTMs, server-side tagging, CRM quality checks.

➡️ Lock naming, UTMs, and on-page SEO basics so platforms and GA4 agree on what’s being measured.

- Meso (month-to-quarter): geo holdouts/lift tests across CTV, radio, OOH, social to prove incrementality.

- Macro (quarter+): lightweight MMM or budget-response curves to tune the brand/activation split.

Pros and cons

Traditional Marketing

TV/CTV, radio, print, OOH, direct mail… all fall under the bracket of traditional marketing.

| Pros | Cons |

|---|---|

| Unmatched reach | Slower learning loops |

| Cultural impact | Higher fixed costs |

| Durable memory effects | Difficult last-click attribution (you’ll use lift/MMM) |

| Trusted environments | |

| DM can be tactile and targeted |

➡ ️ Use when: you need to scale fast, your category has weak search intent, or you’re entering/defending a market.

Digital Marketing

Search/SEO, social media platforms and ads, display/programmatic/retail media, email marketing, influencer/creator etc. are all part of digital marketing.

| Pros | Cons |

|---|---|

| Precise targeting | Auctions get expensive |

| Rapid iteration | Walled-garden blind spots |

| Granular reporting | Performance plateaus without brand |

| Easier to test offers/creative at scale |

➡ ️ Use when: capturing active demand, experimenting quickly, or working with constrained budgets.

Recommended starter splits (editable in the calculator)

Local Lead Gen (SMB)

Search 30 % • Social 25 % • Display 10 % • Online Video/CTV 10 % • Influencer 5 % • Email/List 5 % • Radio 5 % • OOH 7 % • Direct Mail 3 % • Print 0 %

D2C Ecommerce

Social 30 % • Search 25 % • Online Video/CTV 12 % • Display 10 % • Influencer 10 % • OOH 5 % • Email 5 % • Direct Mail 3 % • (others 0–5 %)

B2B SaaS / Enterprise

Search 28 % • Social 20 % • Display 10 % • Online Video/CTV 10 % • Email/List 7 % • OOH 8 % • Direct Mail 10 % • Influencer 5 % • Print 2 %

Why start this way? Because the long-term evidence still favors brand + activation before your own tests tell you otherwise (use ~60/40 for many B2C categories; B2B often skews closer to ~46/54). Then move 10–15 % of budget monthly toward the winners. (These ranges are widely referenced in IPA/B2B Institute literature and modern planning practice.)

Impact on consumer behavior

- Streaming is now the dominant TV use case in the U.S. (and rising elsewhere), so CTV/online video belongs in any reach plan.

- Digital news habits are normal: more than half of U.S. adults sometimes get news via social; smartphones are the main access point. Creators’ ad revenue is on pace to outgrow traditional media.

- Implication: plan for hybrid journeys; big reach to seed memory + digital systems to capture intent.

Best practices

- Define the single job. Launch, promo, pipeline, or entry. Your job chooses the mix.

- Decide the split. Use the starter allocations above, then move 10–15 % of budget monthly toward winners based on lift/holdouts (not just platform ROAS).

- Lock naming + UTMs. No clean UTMs = no signal. Build a one-page taxonomy and enforce it.

- Coordinate reach and harvest. CTV/radio/OOH schedule → synchronized search/social/retail bursts.

- Upgrade creative operations. In digital, test message × format × audience; in traditional, invest in distinctive brand assets that survive tiny exposures (logos, colors, sonic cues).

- Measure three ways. Micro (GA4/CRM), meso (incrementality), macro (MMM). Triangulate, don’t cherry-pick.

- Document learning. One page, monthly: what to scale, what to kill, what to test next.

The role of AI

AI’s job in marketing is to speed up decisions you already know you need to make. In planning, it helps fit lightweight MMM/budget-response curves so you can see “if we move 10 % from radio to CTV, what happens to reach and sales?” It’s pattern-spotting, not prophecy. Feed it clean spend, reach, and outcome data; keep the model simple; rerun it monthly; and use the output to set rules (e.g., shift 10–15 % toward channels with proven lift). In creative, use AI to spin fast variants for social and online video, then keep a brutal human edit: kill weak lines, keep distinctive assets, and test only what you can afford to learn from. AI won’t save a bad brief or a boring offer. It only makes iteration cheaper.

In operations, treat AI like a 24/7 QA analyst. It flags odd spend spikes, frequency bloat, or a falling conversion rate before your morning stand-up. You still decide the fix. For search and retail media, let it mine queries and build tighter ad groups; you approve negatives and budget caps. In CTV/programmatic, use AI for bidding and frequency control across fragmented inventory, but pin hard guardrails: max frequency by audience, daily spend ceilings, brand-safe lists. Start small, log every change, and tie each AI suggestion to a metric you can measure: lift, CPA, or reach. Not gut feel.

Macro signal: AI-powered ads, especially in CTV, are a key growth driver cited by PwC; Dentsu forecasts also highlight “algorithmic” media steering. Treat AI as a copilot for measurement and creative iteration, not a magic trick.

The calculator (because math beats vibes)

We included a lightweight sheet with editable CPMs and scenario mixes. Change the assumptions, see the spend and impressions by channel, and sanity-check your plan before you buy.

→ Download: Digital vs Traditional Budget Calculator

30-day plan

- Pick one job to be done.

- Select the starter split; paste your budget into the sheet.

- Replace CPMs with vendor quotes; lock UTMs.

- Launch one geo holdout (CTV/radio/OOH) and one creative test (search or social).

- Weekly readout; shift 10–15 % of spend to the winner; pause the loser.

- Produce one brand asset (video or OOH) and one UGC/creator variant.

- Publish a one-page learning report and set the next hypothesis.

Wrap Up

This isn’t about marketing vs digital ideology. It’s about the right job for the right tool, then proving it with measurement and moving budget to what works. You’re getting current market data, a jobs-based framework, a measurement plan that matches the cookie reality in 2025, and a calculator to run your own numbers. That’s what decision-makers need. Not platitudes.

So use the matrix, run the calculator, launch the 30-day plan, and publish the learning. Repeat.

👉 If you find yourself stuck with your *digital marketing*, just reach out to Digillex. We’ll take it from there.

Set Up Your Full-Funnel System

FAQs | Digital Marketing vs Traditional Marketing

Which type of marketing should we use?

Start with the job. If you need reach to create demand, you cannot skip traditional channels (CTV/radio/OOH). If you need conversions now, lean digital (search, retail media, social) but keep a baseline brand layer to avoid plateau. In most cases, you’ll run hybrid.

How do digital and traditional work together?

Traditional creates mental availability; digital captures active intent. Coordinate timing and creative: when the TV commercial/OOH goes live, align search and social with the same idea and language. Measure with lift tests and MMM, not last-click alone. Streaming’s surge is the bridge, CTV is both “traditional-like reach” and “digital-like targeting.”

Will digital replace traditional?

Digital already dominates spend, but reach media remains essential. Even in 2025 forecasts, traditional’s role doesn’t vanish; it evolves (CTV, addressable, DOOH). The question isn’t replacement, it’s balance.

Glossary

- CTV: Connected TV

- OOH: Out-of-Home

- ABM: Account-Based Marketing

- MMM: Marketing Mix Modeling

- UTM: Urchin Tracking Module

- GA4: Google Analytics 4

- CPM: Cost Per Mille (“mille” is Latin for “thousand”)

- CPC: Cost Per Click

- CMA: Competition and Markets Authority

- CRM: Customer Relationship Management

- IPA: Institute of Practitioners in Advertising

- ROAS: Return On Advertising Spend

- CPA: Cost Per Action

- PwC: PricewaterhouseCoopers

- UGC: User-Generated Content

- DOOH: Digital Out-of-Home advertising